Mastering EB-5 Investment Amount criteria to avoid application delays

Maximize Your Investment: A Detailed Check Out the EB-5 Visa Chance

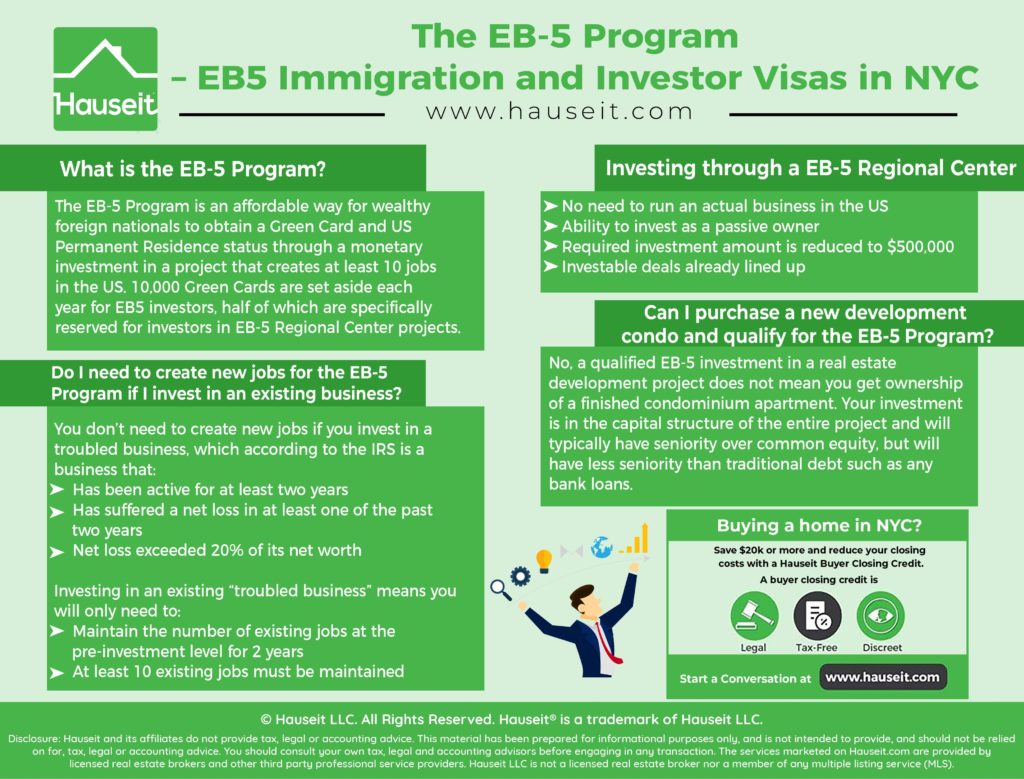

The EB-5 Visa program offers a compelling opportunity for international capitalists seeking permanent residency in the United States with strategic financial commitments. With varying financial investment limits and the capacity for significant economic effect, this program not just facilitates immigration however additionally aligns with broader objectives of job development and community growth. Nevertheless, maneuvering through the intricacies of the application procedure and comprehending the associated risks are necessary for optimizing the advantages of this chance. As we check out these elements, key insights will arise that might considerably influence your investment strategy.

Overview of the EB-5 Visa

The EB-5 visa program uses an one-of-a-kind path for foreign investors looking for irreversible residency in the United States, enabling them to acquire a visa by purchasing united state organizations. Developed by the Immigration Act of 1990, the program aims to promote the U.S. economy via capital expense and job production. It is created for people who can meet details requirements, consisting of the financial investment of a minimum necessary quantity in a brand-new company.

The EB-5 program is noteworthy for its emphasis on job production; investors should show that their financial investment will maintain or create at the very least 10 full time jobs for united state workers. This focus on financial benefit straightens with the program's goal of drawing in foreign funding to boost regional economic situations. Furthermore, the EB-5 visa makes it possible for financiers and their prompt relative to stay in the U.S. while taking pleasure in the benefits of irreversible residency.

Financial Investment Demands and Choices

Financiers thinking about the EB-5 visa program must abide by details investment requirements that determine the minimal resources required for qualification. Since 2023, the conventional financial investment quantity is $1 million. If the financial investment is routed toward a Targeted Work Location (TEA)-- specified as a rural area or one with high unemployment-- the minimum demand is minimized to $800,000. (Targeted Employment Area TEA)

The EB-5 program supplies two key opportunities for investment: Direct Investment and Regional Facility Financial Investment. Direct investment entails the financier developing or investing in a new commercial business that produces at the very least ten permanent tasks for qualifying U.S. employees. This course may require much more energetic involvement in business operations.

Alternatively, Regional Center financial investment allows financiers to add to pre-approved projects handled by marked Regional Centers. This alternative often provides an extra easy investment chance, as the Regional Facility takes on the duty of work development and conformity with EB-5 regulations.

Advantages of the EB-5 Program

Joining the EB-5 program opens up a path to countless advantages for foreign investors looking for united state residency. One of the primary advantages is the chance for capitalists and their instant relative to get an U.S. visa, approving them permanent residency. This condition permits individuals to live, function, and study throughout the USA, offering accessibility to a wealth of sources and opportunities.

Furthermore, individuals in the EB-5 program advantage from the security and security connected with U.S. residency, consisting of the defense of properties and the capability to travel freely in and out of the country. Generally, the EB-5 program presents a special opportunity for international financiers to obtain residency while adding to the united state economy, making it an appealing alternative for those looking for brand-new starts.

Job Production and Economic Impact

The EB-5 visa program plays an important duty in stimulating job development and cultivating economic growth in the United States. By drawing in international financial investment, it not only produces brand-new employment possibility but additionally enhances regional economic situations. Comprehending the program's effect on task markets and economic growth is necessary for possible capitalists and communities alike.

Job Development Prospective

Harnessing the capacity of the EB-5 visa program can significantly add to work production and financial development within targeted locations. The program mandates that each foreign investor contribute a minimum of $900,000 in a targeted employment area (TEA) or $1. EB-5.8 million in other regions, with the goal of developing or preserving at the very least 10 permanent work for united state workers. This requirement not only incentivizes foreign financial investment yet additionally boosts neighborhood economies by generating employment opportunities

Projects moneyed via the EB-5 program usually concentrate on markets that are critical for growth, such as property growth, friendliness, and infrastructure. These initiatives can result in the establishment of brand-new services, expansion of existing business, and inevitably, a stronger labor force. Furthermore, the influx of resources from EB-5 investors permits for the endeavor of large-scale tasks that would or else be impractical, thus boosting task creation capacity.

In addition to route employment, the causal sequence of task creation expands to supplementary solutions and markets, promoting a robust financial environment. The EB-5 visa program, as a result, plays a crucial role in driving work development and supporting regional communities, making it a strategic financial investment possibility.

Financial Growth Contributions

EB-5 financiers' payments to financial development expand beyond mere task creation, including a large selection of favorable effect on regional and regional economic climates. By spending a minimum of $900,000 in targeted work areas or $1.8 million in non-targeted areas, these investors help with the establishment and development of businesses, which invigorate community infrastructures and services.

The capital influx from EB-5 investments commonly brings about the growth of brand-new business tasks, realty endeavors, and necessary solutions. This not just creates straight employment possibility however likewise promotes indirect work growth within supporting markets, such as building and construction, friendliness, and retail. EB-5 Investment Amount. Moreover, enhanced company task improves tax obligation profits, offering city governments with extra resources to money civil services and infrastructure renovations

The broader financial effect of the EB-5 program includes enhanced customer costs, enhanced home values, and improved area features. As a result, areas that attract EB-5 financial investments commonly experience a revitalization of regional economic situations, cultivating a setting helpful to sustainable development. Ultimately, the EB-5 visa program works as an effective tool for financial development, benefiting both capitalists and the communities in which they invest.

The Application Refine Explained

The application procedure for the EB-5 visa entails a number of important actions that potential financiers should browse to safeguard their visa. Recognizing the eligibility needs is vital, as this structure will direct applicants with each stage of the procedure. In the following sections, we will lay out these requirements and supply a thorough step-by-step guide to successfully completing the application.

Eligibility Demands Review

Navigating via the eligibility requirements for the EB-5 visa can be a complicated process, however recognizing the vital elements is essential for prospective investors. The EB-5 visa program is developed for foreign nationals seeking long-term residency in the United States with investment in a new business. To certify, a candidate should invest a minimum of $1 million, or $500,000 in targeted employment areas (TEAs), which are specified as rural or high-unemployment regions.

In addition, the investor has to show that the investment will develop or preserve a minimum of 10 permanent work for certifying U.S. workers within two years. It is additionally necessary for the applicant to prove that the funds used for investment are legitimately gotten, requiring complete paperwork of the source of funding.

The investor must be proactively involved in the company, although this does not require day-to-day monitoring. Conformity with these qualification needs is necessary, as failure to fulfill any type of criteria can lead to the rejection of the visa. Comprehending these elements not only help in preparing a durable application however likewise enhances the probability of successfully steering the EB-5 visa process.

Step-by-Step Refine

Steering via the application process for an EB-5 visa requires a methodical approach to assure all requirements are satisfied efficiently. The very first step entails choosing a suitable investment task, ideally within a marked Targeted Employment Area (TEA) to take full advantage of advantages. After determining a task, it is vital to perform extensive due persistance to evaluate its feasibility and conformity with EB-5 policies.

Next off, candidates should prepare Type I-526, Immigrant Request by Alien Capitalist, describing the investment's source of funds and financial influence - EB-5 Visa by Investment. This kind is gone along with by supporting paperwork, consisting of evidence of the financial investment and proof of the job's work production possibility

Upon approval of Kind I-526, applicants can continue to request an immigrant visa via consular handling or adjust standing if currently in the U.S. This includes sending Form DS-260, Application for an Immigrant Visa and Alien Registration.

Common Challenges and Factors To Consider

Maneuvering the EB-5 visa process provides a number of typical difficulties and factors to consider that prospective capitalists have to carefully assess. One main worry is the considerable economic investment needed, which currently stands at $1.05 million or $800,000 in targeted work locations. This considerable capital commitment demands extensive due diligence to ensure the project is feasible and lines up with the financier's financial objectives.

Another challenge is the prolonged handling times linked with EB-5 applications, which can extend beyond 2 years. Capitalists have to be gotten ready for feasible hold-ups that could impact their immigration timelines. Furthermore, the need to develop or preserve at the very least 10 permanent work can complicate job choice, as not all endeavors ensure work production.

Moreover, the risk of investment loss is a vital consideration. Financiers ought to seek jobs with a strong record and clear monitoring to mitigate this threat. Finally, adjustments in migration plans and laws can affect the EB-5 program's stability, making it essential for capitalists to remain notified regarding legal developments. A detailed understanding of these difficulties will enable possible capitalists to make educated decisions throughout the EB-5 visa procedure.

Success Stories and Situation Studies

The EB-5 visa program has actually made it possible for many investors to achieve their migration goals while adding to the united state economic climate through task development and capital financial investment. A remarkable success story is that of a Chinese entrepreneur that bought a local facility concentrated on renewable resource. His financial investment not only safeguarded his family's visas yet likewise facilitated the development of over 200 jobs in a battling neighborhood, highlighting the program's double advantages.

One more engaging situation involves a team of investors that pooled sources to develop a high-end hotel in a metropolitan location. This job not only produced substantial employment possibility but additionally revitalized the regional tourist industry. The capitalists successfully gotten their visas and have considering that increased their company profile in the united state, further demonstrating the capacity for development via the EB-5 program.

These examples highlight just how calculated investments can result in individual success and broader economic effect. As possible investors think about the EB-5 visa, these success tales function as a verification of the program's potential to transform areas and lives alike, urging further involvement in this useful possibility.

Often Asked Inquiries

What Is the Typical Processing Time for an EB-5 Visa?

The common processing time for an EB-5 visa differs, usually ranging from 12 to 24 months. Factors influencing this timeline include application volume, individual scenarios, and local facility authorizations, influencing total handling performance.

Can My Family Join Me on the EB-5 Visa?

Yes, your family members can join you on the EB-5 visa. Spouses and unmarried children under 21 are eligible for acquired visas, permitting them to get permanent residency together with the key applicant in the EB-5 program.

Are There Certain Industries Preferred for EB-5 Investments?

Yes, particular markets such as actual estate, friendliness, and infrastructure are usually chosen for EB-5 financial investments. These industries generally show solid development capacity, job production capacity, and placement with united state economic growth objectives.

What Occurs if My Investment Falls short?

It may jeopardize your qualification for the EB-5 visa if your investment fails. The United State Citizenship and Immigration company website Services calls for proof of job development and capital in danger; failing to satisfy these can lead to application denial.

Can I Live Throughout the U.S. With an EB-5 Visa?

Yes, owners of an EB-5 visa can live throughout the USA. This adaptability permits financiers and their families to pick their favored areas based on individual requirements, employment possibility, and way of living preferences.

The EB-5 visa program offers an one-of-a-kind pathway for international investors looking for irreversible residency in the United States, enabling them to obtain a visa by spending in United state companies. Investors interested in the EB-5 visa program need to stick to details financial investment requirements that dictate the minimal capital necessary for eligibility. The EB-5 program uses two key opportunities for investment: Direct Financial investment and Regional Facility Financial Investment. Understanding these financial investment needs and alternatives is important for possible investors aiming to browse the intricacies of the EB-5 visa program effectively. The EB-5 visa program has allowed numerous investors to achieve their migration objectives while contributing to the U.S. economic climate via job creation and funding financial investment.